Bitcoin Price Falls $8K to 3-Week Low, Altcoins Crash

Bitcoin Price Falls $8K to 3-Week Low, Altcoins Crash

18th, April 2021 (2 weeks ago)

News

Bitcoin nosedived to a three-week low of $52,148 during Sunday's Asian hours.

Bitcoin’s price rally in the days leading up to Coinbase’s hotly anticipated debut on the Nasdaq this week was largely driven by retail traders eager to get in on the action while whales were happy to take their money and swim away, blockchain data shows.

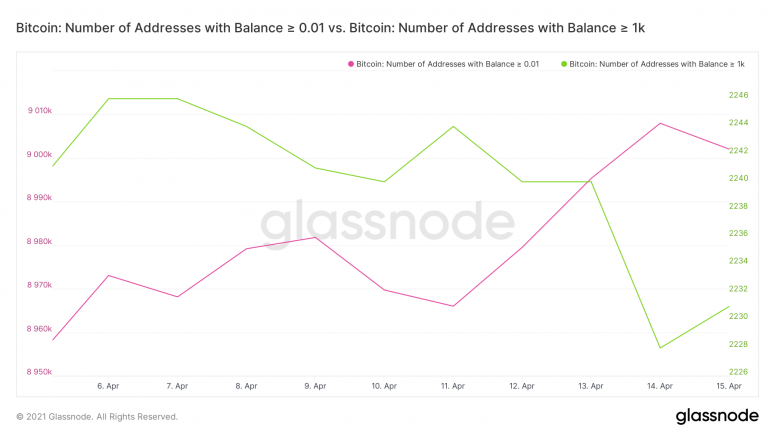

The number of unique addresses holding at least 0.01 coins rose from 8.96 million to over 9 million in the five days to April 14, alongside bitcoin‘s ascent from $59,000 to a record high of $64,801.79, according to data provided by the blockchain analytics firm Glassnode. The count of addresses with non-zero balance and ones holding least 0.1 coins also rose in tandem with the price.

Meanwhile, those with a minimum balance of 1,000 BTC – also known as the rich list – dropped from 2,240 to 2,228. The tally of “whole coiners,” or addresses with a minimum balance of one coin, fell amid the price rise.

“The pre-Coinbase IPO rally was driven by retail investors, in mass,” Flex Yang, CEO of Hong Kong-based Babel Finance, said in an email. “We saw that the continuing decline of whales on the network further indicated that the decentralization of the Bitcoin network was really taking place.”

Some readers may argue that the diverging trends in the growth of small and large balance addresses may mearly represent the trend of whales holding coins in several addresses to mitigate hacking risks. A single user can store coins in multiple addresses. Similarly, exchange addresses have coins belonging to more than one individual.

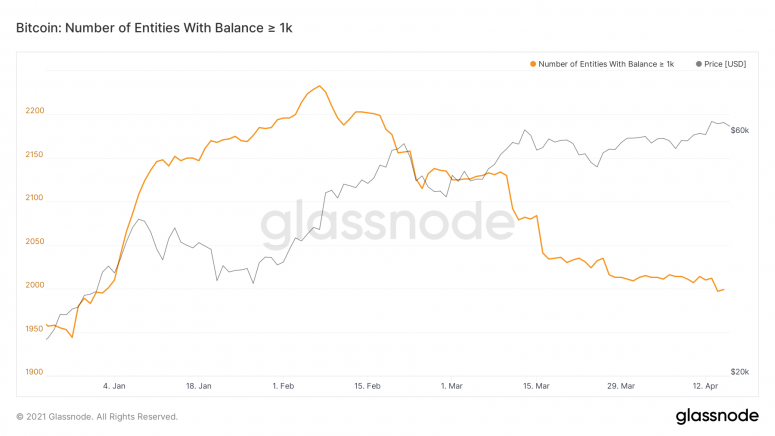

However, Glassnode’s whale entities metric, which clusters crypto wallet addresses held by a single network participant holding at least 1,000 bitcoin to provide a more precise estimate of the actual number of holders, also points to continued liquidation by large traders during the cryptocurrency’s move to record highs.

The number of whale entities fell to a 3.5-month low of 2,228 on April 14. The metric decoupled from the rising price in February and dropped by 10% to 2,232 seen in the seven weeks to March 31.

It shows retail investors’ high level of engagement began in the first quarter and continues to the present.

Some observers, however, say these charts do not provide sufficient information, leaving the doors open for guesswork.

“The whale entities chart could show that smaller retail investors are purchasing bitcoin, and large holders are selling into that rally,” Gavin Smith, CEO of the cryptocurrency hedge fund Panxora told CoinDesk in LinkedIn chat. “It could also be showing that a smaller number of large investors is buying bitcoin, so the large entities’ concentration is increasing.”

According to Smith, the latter is the case. “We are seeing some very large investors moving into the market, and their assets are concentrated in a small number of fund and custodial accounts. Retail involvement has been lower this cycle than in 2017,” Smith said.

Whatever the case, the path of least resistance for bitcoin remains on the higher side, as the “suits [institutions] are here to stay,” as CoinDesk’s research analysts noted in the first quarter review. Options traders continue to accumulate the $80,000 call option in a sign of strengthening bullish conviction on the top cryptocurrency.

Bitcoin is trading near $61,000 at press time, according to CoinDesk 20 data.

Coinbase's Public Listing Driving Crypto Interest to All-Time-Highs

It's a wild time in the crypto sphere. Coinbase's public listing pushed bitcoin to a new all-time high, but it's not the only cryptocurrency that's doing well in the current bull market. Jason Lau, COO of OKCoin, joins "First Mover" to talk about the altcoin rally and why he thinks investors are drawn to the alt market. Plus, his thoughts on the international crypto markets and the potential impacts of U.S. regulation.

Share:

twitter facebook linkedin redditYou MUST be logged in to like, dislike and comment on this post

Featured

cberry

16 Dec

9 0 $0.933312

cberry

03 Dec

50 0 $1.42

Trending

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

Highest Earning

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

oioolli

oioolli