Current Defi/Yield hacking activities Q4/2020

Current Defi/Yield hacking activities Q4/2020

22nd, December 2020 (4 months ago)

Cryptocurrency

These are the primary yield aggregator and liquidity provider protocol platforms that I am currently making use of, based on my current testing and evaluation methodology. I have taken into account yield and risk, but strategies are subject to change, since this space is moving so fast. New protocol products are constantly being released, and older ones become lower layer financial primitives (or otherwise fade away).

Introduction

These are the primary yield aggregator and liquidity provider protocol platforms that I am currently making use of, based on my current testing and evaluation methodology. I have taken into account yield and risk, but strategies are subject to change, since this space is moving so fast. New protocol products are constantly being released, and older ones become lower layer financial primitives (or otherwise fade away). I am currently focusing on eth based projects, but also 3 scaling solutions. Two are side (or sister chains) and the other is an Eth L2 solution to provide more speed, and lower fees. This will continue to develop, and many new solutions are being introduced on eth and also other chains as well. It is important to weigh the advantages and disadvantages before making a decision. But the scaling solutions are more forgiving to mis-steps, testing, and smaller amounts since the fees are so low, and the transactions are so fast. You can easily change your mind, or chase better rates if they crop up somewhere else since the cost to move things around is so low. On the other hand, eth still has the most mature platforms which have been battle tested, and the most liquidity for trading etc. One of the criteria that I use for testing/evaluation is that the project must be live on mainnet. There are many promising projects that I am following, but cannot do an adequate evaluation without testing the live mainnet version. I have also done some testing on the Xdai L2 solution, and the Tron chain, but I decided to focus on the ones below for various reasons. Of course this could change in the future, as development and adoption increases.

Eth (main benefit is maturity, liquidity and breadth of alternatives)

- Yearn - They are the OG yield aggregators. They were the first to provide yield farming as a service to investors that didn't want to have to constantly monitor and harvest their yield. The rates in the vaults have gone down significantly as the yield farming craze has died down, and they will be deploying new strategies, and version 2 of the vaults. The governance token went way up, but has gone down to a more realistic level. They are the most innovative in the space, and will be adding new services in the future.

- Uniswap- The most popular AMM (automated market maker DEX), with the highest liquidity and transaction volumes. You can provide liquidity in the featured pools, and stake the pool redemption tokens to earn Uni governance tokens, in addition to the small share of transaction fees. Returns are are reasonable, but the downside is being subject impermanent losses if price ratio between the trading pair changes a lot.

- Balancer- Similar to Uniswap, but there is more flexibility in the trading pairs, You can have more than 2 tokens in a pool, the ratios don't have to be 50%, and you don't have to use eth if you don't want to. So, you can reduce, but not eliminate impermanent losses, and many of the pools are incentivised to earn Bal governance tokens. There is another article in my blog where I talk about the various balancer pools, and how to earn rewards.

- Curve- Similar to Uniswap and Balancer, but mostly optimized for stablecoins and wrapped btc pools. You can earn CRV governance tokens, or stake the Curve pool tokens in yearn for higher rates of return. (see above). If you are not familiar with curve, here is an article which describes it in more detail.

- DoDo - Similar to the above AMM's but eliminates impermanent losses. You can provide liquidity for a single side of a trading pair, or any ration, and also receive Dodo governance tokens. Its also runs on Binance smart chain, if you are interested in reducing network fees, but the mining part isn't there yet. Here is a good article which describes how Dodo works, and why it is so innovative.

- Synthetix- The OG synthetic derivative digital asset platform, which is performing quite well. They are also a pioneer on the L2 optimitisric rollup platform, and you can get SNX rewards by testing the susd minting process on L2. The L1 platform has become too expensive for staking small amounts to claim rewards. And the rewards are vested for 1 year, before you can get them in your wallet. Here is an article which describes it in more detail.

- Aave - Money market, for lending and borrowing similar to compound, with collateralised loans. You can now stake the new governance tokens (migrated Aave from Lend) to earn about 8% APR for relatively low risk, and the token has been one of the best performers over the last year to date. They are also one of the first in the space to become licensed bankers, which will enable under-collateralised loans in the future.

- Index Coop- Collaboration between defi pulse and set protocol to maintain a decentralised Defi index (similar to a crypto native ETF). This enables you to invest in the best performing/lowest risk Defi tokens at once. You can earn Index tokens by providing liquidity.

- Nexus Mutual- This smart contract insurance platform allows you to invest in the insurance pool for various defi smart contracts (see above). You can chose ones that best suit your risk/return profile, since you may lose your deposit if a large claim has to be paid.

- Cream- Invest single crypto asset, or pair of tokens to earn cream governance tokens, which can be re-invested. It originally came from the compound source code, and a number of new features have been added.

- ValueDefi- They are probably the most successful of the numerous Yearn copies (forks), and have gone thru various iterations. The platform is settling down after so many changes/improvements. Their rates are quite good for liquidity pairs, and also for the vaults. They have re-branded and changed the name of their governance token to "value". Here is a more detailed description of the project.

BSC (main benefit is faster, cheaper, and coins from other chains are supported)

- Cream- Similar to the eth version, but doesn't include some of the liquidity mining features. However, it does include some additional coins which are not supported in the eth version, like BNB, DOT, and ADA for example. For the latest updates on Cream, you can check their medium blog.

- Pancakeswap - Pretty good incentivised yield farming platform, similar to something like Sushiswap, but is much faster, and cheaper. It makes sense to reduce your gas costs, especially if you are not investing huge amounts. This makes the ROI higher for a given APR.

- For.tube- Money market, similar to Cream. Runs on both eth and BSC.

There is very little cost to switching, if rates are better on another defi service since network fees are so low. That is the main advantage of scaled solutions vs. eth.

Add BSC to metamask networks: Click on network (where it says eth mainnet), Select ‘Custom RPC’

Enter in the BSC mainnet details as follows:

Network Name: BSC Mainnet

New RPC URL: https://bsc-dataseed1.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com/

Then press “Save”

Matic (L2 solution for eth with faster speeds, and lower fees)

- Quickswap - Fork of Uniswap running on the Matic L2 scaling solution. They have incentivised pools, similar to Uniswap, but the quick governance token was not listed on coingecko yet, so still discovering price, and liquidity

- Easyfi - Money market running on Matic, with incentivised rewards for liquidity

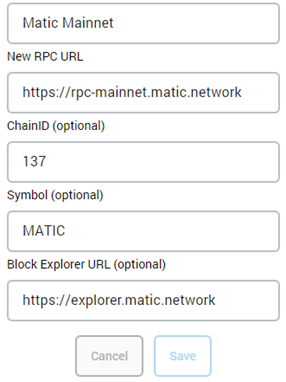

To configure metamask - Enter in the following information and click Save:

Kava/Cosmos (connect using Trust wallet)

- Kava- Similar to Maker Dao, but interoperates across chains, instead of eth only. You mint USDx loans for staking BNB as collateral. Works with the Trust mobile wallet. You have to maintain a collateralization ratio, or risk getting liquidated (similar to Maker Dao and Dai) You also get Kava tokens as a reward, but they have introduced a vesting period, which means that your rewards will be locked for a period of time, however that usually tends to increase the value of the token, since it lowers the inflation.

- Harvest.io - Cross chain money market running on the Kava/Cosmos chain. They will also be adding more xchain defi services. You can invest Kava and USDx for interest, and also earn some incentivised rewards for now. (Don't confuse with harvest.finance, which is another project on eth).

Conclusion

This represents a good sample of the current generation of defi protocols. There are many new Defi protocols in various stages of development. Here is an article on some of the most promising defi projects being built on Polkadot. Here are a few more on other platforms- yAxis, Alpha Homora, Venus, Bella, Acropolis, and many more. But they are not live yet. When they are I will start testing, evaluating, and comparing.

For the next generation I see more cross platform support, so that optimised strategies can produce the best overall yields and rates across chains. This will be a "meta" yield aggregation level above the current yield aggregators on individual chains. The primary feature of the next generation of Defi yield aggregators will be interoperability. The space continues to evolve, mature, and grow in terms to total locked-in value (see Dapp Radar).

So, let me know what your favourites are, and why, and what you expect to see in the future.

Share:

twitter facebook linkedin redditYou MUST be logged in to like, dislike and comment on this post

Featured

cberry

16 Dec

9 0 $0.933312

cberry

03 Dec

50 0 $1.42

Trending

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

Highest Earning

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0

US needs to take leadership on central bank digital currencies: former CFTC chair

Brylant

03 May

1 0 $0

Will Elon Musk’s ‘SNL’ Appearance Send Dogecoin to the Moon? Curb Your Enthusiasm

Brylant

06 May

1 0 $0