Marathon Purchases 10,000 Bitcoin Miners, Machines Will Max Out 100 Megawatt Montana Facility

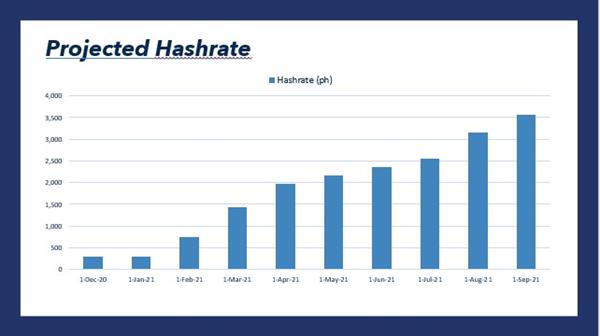

On December 9, the Nasdaq-listed cryptocurrency mining company, Marathon Patent Group, announced the firm is purchasing 10,000 Antminer S-19j Pro units from the Chinese mining manufacturer Bitmain. According to Marathon, after the acquisition of next-generation bitcoin miners, the company will have an aggregate total of 33,560 ASIC miners with up to 3.56 exahash (EH/s) of hashpower.

Marathon Patent Group, Inc. (NASDAQ:MARA) has partnered with Bitmain once again to purchase another 10,000 application-specific integrated circuit (ASIC) bitcoin miners. In addition to the recent purchase, Marathon has noted it is also expanding operations and is currently working with the energy producer Beowulf Energy.

Marathon details that with Beowulf Energy’s help, it plans to open a new “renewable energy-powered data center in the northeastern United States.” According to the announcement, Beowulf plans to supply Marathon with a 100 (MW) megawatts of energy and the ability to upgrade to 250MW.

Marathon says that 6,000 S-19j Pro miners will be shipped in August 2021 and the latter 4,000 will be delivered to the firm’s Montana facility. After Bitmain completes the deal, Marathon’s Hardin Montana data house will be maxed out with a consumption level of 100MW.

The company says the Big Horn County bitcoin mining facility will host a total of 33,560 ASIC bitcoin miners with 3.56 exahash per second of SHA256 hashrate. Merrick Okamoto, Marathon’s chairman and chief executive officer, explained that the firm is pleased that it met the maximum requirements at the Hardin data-house in Montana.

“We are pleased to have successfully completed the purchase of all ASIC Miners required to fully utilize our 100 MW data center in Hardin MT,” Okamoto said. We are now looking forward to our next phase of growth as we build out our second data center. The new facility will be powered primarily by clean, renewable power, which is not only cost-effective, but will also allow us to lower our carbon footprint.”

Okamoto further added:

Currently, we believe the costs to operate our second facility will be similar to the industry-leading rates we have at our Hardin facility: $0.028 per kWh for power and $0.006 per kWh for hosting operations.

At current bitcoin prices, and if electrical costs are truly around $0.028 per kWh at the Hardin facility, then any ASIC bitcoin miner with a hashrate between 80 to 100 terahash will capture over $8.50 or more a day per unit. With the Bitcoin network’s current difficulty at 19.16T and present market prices per unit, Marathon’s Hardin facility with 3.56EH/s can ostensibly capture 14.5 BTC per day, using today’s current estimates and figures for the average of 33,000+ 80TH/s machines.

Marathon has been trying to capture a lion’s share of the hashrate derived from the Western side of the world, but the company is also competing with top operations such as Hut8 and Riot Blockchain as well.

For More Info Click Here --??

Easy earn money

What Is Technical Analysis?

Related post

1 comments

cryopto2022

6 months agoYou MUST be logged in to like, dislike and comment on this post